This limits how much money you can take out of that operator’s machines over the course of a single day. For example, say your bank has a $1,000 withdrawal limit and you use an ATM with a $600 limit. This means that you can withdraw up to $600 from that ATM operator’s machines in a single day, but you can withdraw an additional $400 from.. Bank of America: The maximum daily withdrawal amount using an ATM is $1,000. The limit is $800 for ATM withdrawals set up in advance using the bank’s mobile app. Capital One: ATM withdrawals.

How Much Can You Withdraw From an ATM? [Banking Basics] GlobalBanks

How to withdraw money from an ATM without a debit/credit card HT Tech

/75404663-F-56a7f9c55f9b58b7d0efc870.jpg)

Can I Withdraw Money from My 401(k) Before I Retire?

ATM Withdraw Limit Big News! How much cash can you withdraw from ATM

How much money can you withdraw from an ATM in one day? YouTube

How to Withdraw CASH using METROBANK ATM MACHINE? GUIDELINES/ ACTUAL

How Much Can You Withdraw From Suncoast Credit Union Atm Credit Walls

How to Withdraw Money from ATM Machine 7steps UandBlog

SBI ATM SE PAISE KAISE WITHDRAW KARE /HOW TO WITHDRAW MONEY FROM SBI

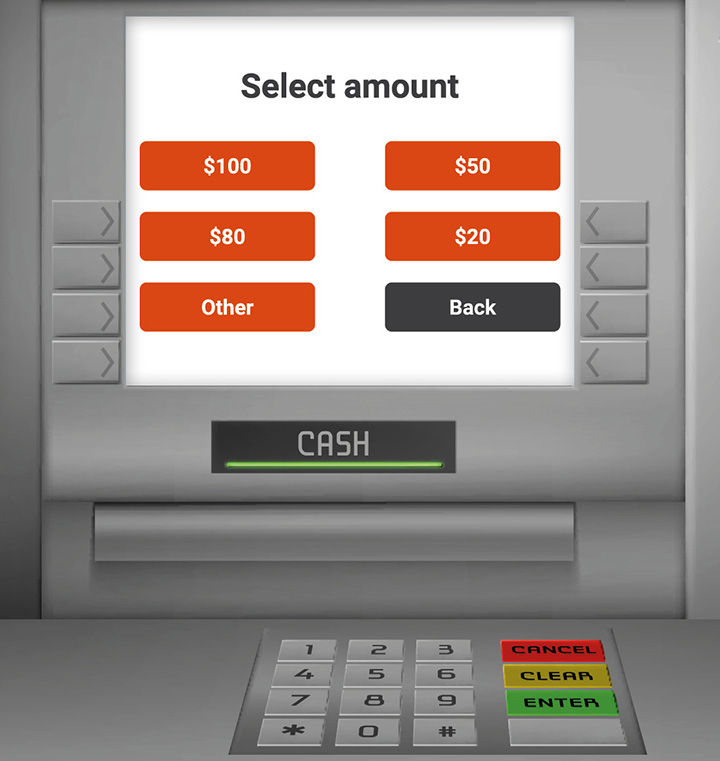

Using other touchscreens (ATM)

How Much Money Can You Take Out of an ATM? Exploring Withdrawal Limits

How Much Can You Withdraw from a Wells Fargo ATM? A Comprehensive Guide

Can you withdraw 300 from an ATM? Leia aqui Which ATMs let you

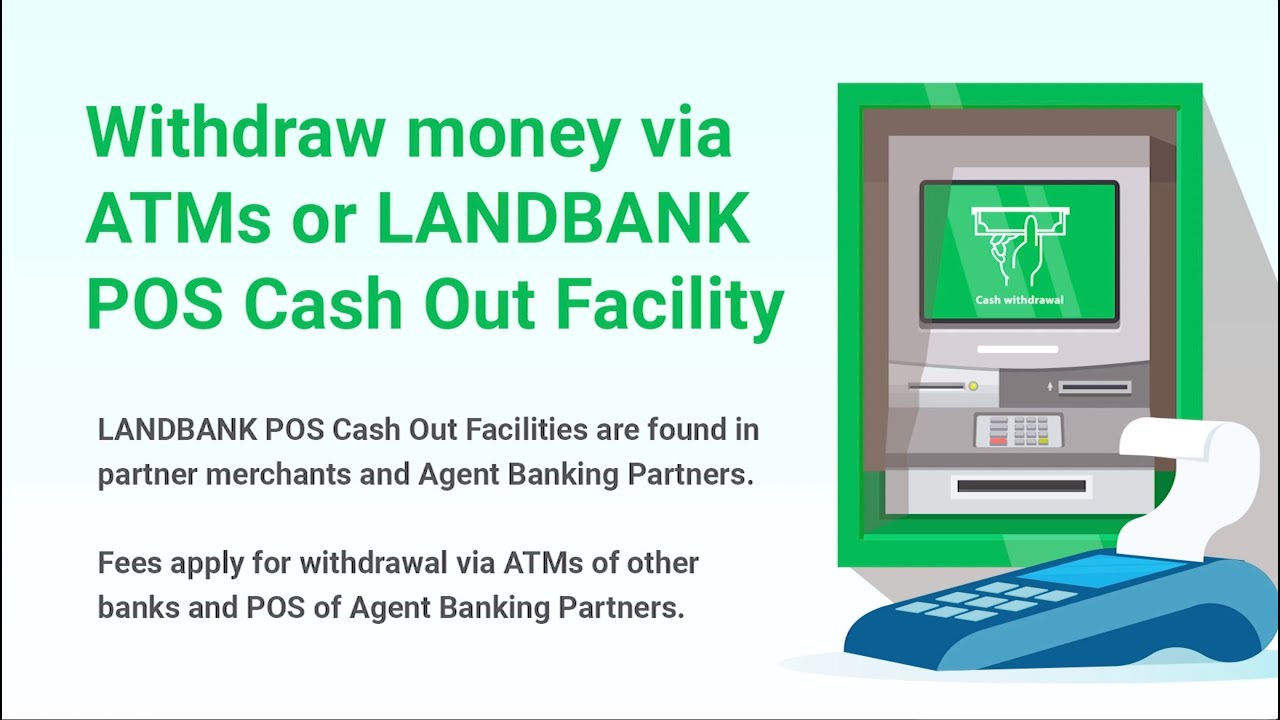

How to withdraw money using ATMs and LANDBANK POS YouTube

How much can you withdraw from an ATM? Maximum cash withdrawals for UK

How much can you withdraw from an ATM? Maximum cash withdrawals for UK

How To Withdraw Money From SBI ATM With Any BANK ATM Card YouTube

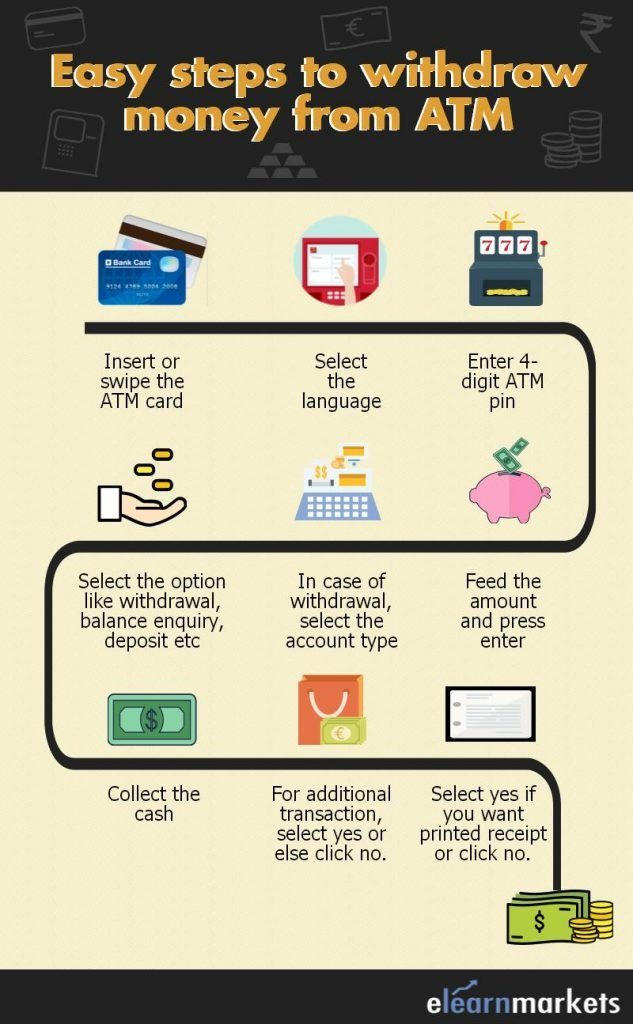

9 Steps to Withdraw Money from ATM Machine

How much money can you withdraw from an ATM? Maximum for all UK banks

PROSPECTOR — How much money can you withdraw from an ATM?…

An ATM withdrawal limit restricts the amount that a bank or credit union allows for withdrawal from an ATM. While this withdrawal limit might sometimes feel like a nuisance, it can be helpful when you are trying to manage your spending. As helpful as these functions are, sometimes you may need access to more cash – be it for emergencies or for.. Keep in mind that if the withdrawal is in a currency other than U.S. dollars, you’ll be charged an additional fee of 3% of the withdrawal. Contact your bank ahead of time if you plan to travel.