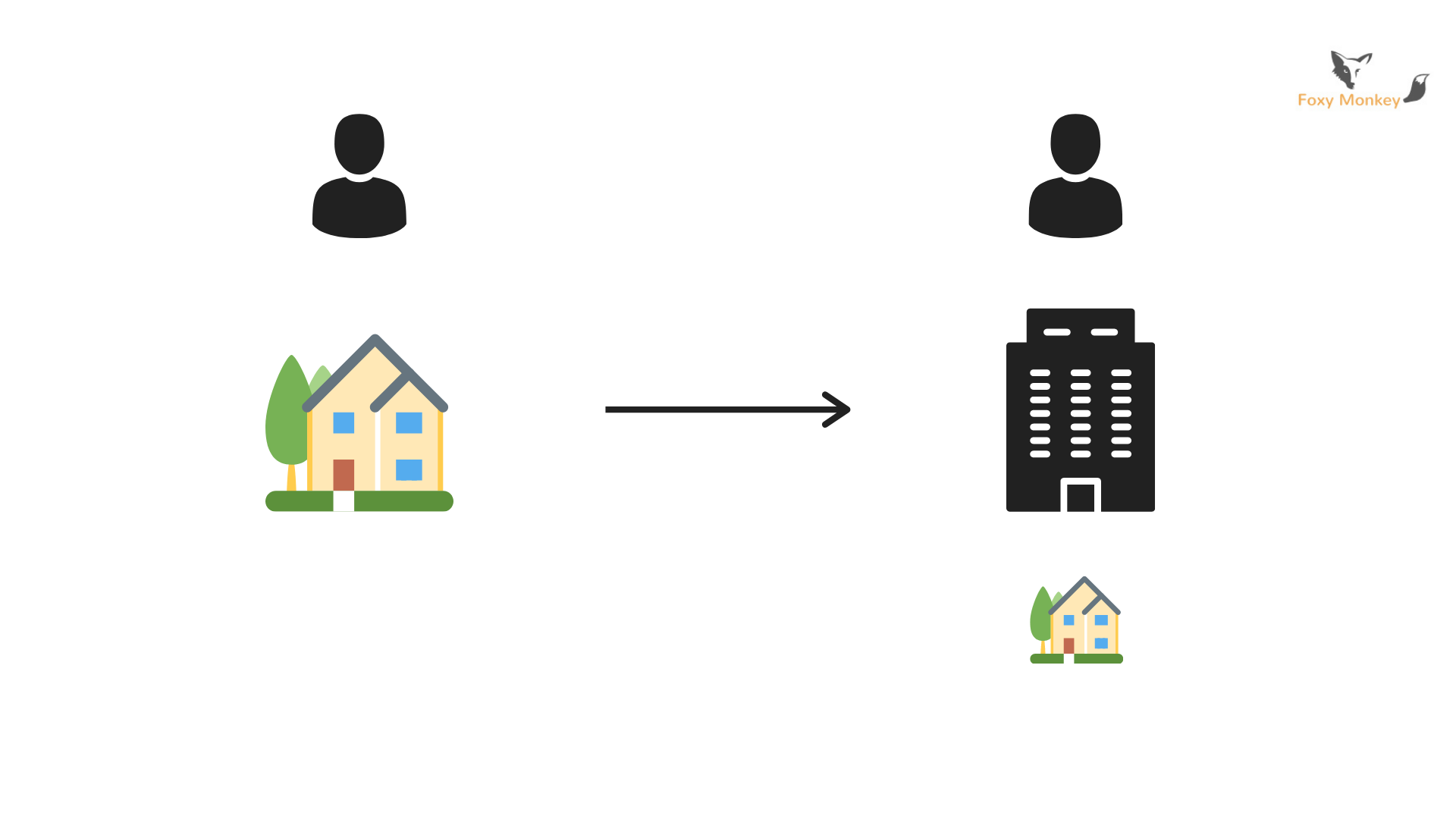

The choice to purchase a buy-to-let property either as an individual or through a limited company has its advantages and disadvantages to consider. Buying as a limited company is the preferred choice for some people because of the obvious tax benefits and the protection of personal assets from losses if the investment goes wrong.. When a limited company sells a property, no Capital Gains Tax (CGT) Allowance is given. An individual who sells a buy-to-let receives a certain allowance – i.e. an amount they don’t pay CGT on. If a private landlord sold their property within the 2022/23 tax year, they would receive an allowance of £12,300.

10 Things To Consider When Buying Property Through a Limited Company

Property118 The Benefits Of Property Investment Through a Limited Company When Buy To Let

Should I Invest through my Limited Company or Personally? PennyBooks

Investing in shares through a limited company

75 LTV Limited Company BuyToLet Mortgages Unveiled by The Nottingham Estate Agent Software

Buy To Let Limited Company

Buying Property through a Limited Company Pros & Cons Foxy Monkey

Limited company buy to let VA Mortgages

Overview of Private Limited Company SPAY & CO

Buy To Let Property Investment Through Limited Company Structures. YouTube

BuyToLet Mortgage Through A Limited Company Landmark Private Finance

Buy to Let Limited Company Mortgage Niche Mortgage Broker

Director’s Guarantee for your Limited Company Future Strategy

Buytolet mortgages through a Ltd company explained Investment Property Forum

Property Investment Through Limited Company Blue Crystal

Personal Limited Company UK & Ireland Vian Outsourced Accounting Services

Buy To Let Limited Companies Why Are Landlords Considering Them?

Buying Property Through a Limited Company CMME

Limited company debts Can I be made personally liable? Future Strategy

Save Tax Buying A Car In Your Limited Company Save Tax

The Limited Company technically owns the property, and that means they can change shareholders, directors, and ownership. Changing owners through personal property sales is tedious and confusing. Instead, you can add a partner to the company or to the buy-to-let portfolio to more efficiently extract funds for tax purposes. LANDLORD CREDIT.. Landlords may opt to buy rental property through a limited company, if it proves to be the more profitable option for them than buying in personal name. The reason it may be more profitable relates to tax. Tax laws relating to property investment were changed in 2017. In each tax year following, until 2020/21, the amount of tax relief on.